Oregonians could be getting a kicker when they file their taxes next year.

State economists said Tuesday that revenues for the current budget cycle are on track to exceed projections by a wide enough margin to trigger Oregon's unique kicker law. But state economist Mark McMullen said it's not a sure thing just yet.

"This is a little bit maddening for this forecast, because we're coming up to the very end of the biennium," he said. "But we're still not 100 percent sure, not even close to 100 percent sure, that we will actually have a kicker."

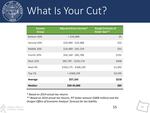

If current projections hold, the average kicker for Oregon taxpayers would be $210, and the median would be $85. The amount won't be finalized until the next revenue forecast, which is scheduled for August 23.

The economic forecast also showed state coffers are expected to be about $187 million fatter over the next two years than the previous forecast showed. That means the budget shortfall for the next two years is a bit smaller than previously thought. It’s down to about $1.4 billion.

But McMullen urged lawmakers not to let the slight increase in projected revenues derail discussions underway in Salem about whether to overhaul the way the state taxes businesses.

"I wouldn't want additional funds here to take any of the momentum away from tax reform," he said. His comment was applauded by Sen. Mark Hass, D-Beaverton, who's been leading the discussions in the Oregon Senate.

Advocacy groups also said the slight uptick in expected revenues shouldn't mean the end of efforts to change the corporate tax code.

"The revenue forecast makes it clear that the Oregon Legislature has no excuse to continue protecting corporate profits at the expense of our students," said Oregon Education Association President Hanna Vaandering. “A good economy should be taken as an opportunity to invest in our future after decades of cuts to public education."

But Republicans at the state Capitol signaled the forecast could make it even harder to get GOP support for overhauling the corporate tax structure.

“These circumstances might be inconvenient for Democratic leaders, who continue to push a narrative that suggests current revenue levels are inadequate," said House Republican leader Mike McLane of Powell Butte. "But for most Oregonians it is just more evidence of the fact that our government needs to tighten its belt.”

Democrats hold a majority in both the Oregon House and Senate, but need at least one Republican vote in order to increase taxes.