Benson Polytechnic High School

Alan Sylvestre / OPB

Portland school board members are nearing a decision to send Oregon’s largest-ever school bond to the ballot this fall. The bond would be for $750 million.

Portland Public Schools' bond committee — a subset of three school board members — discussed the proposal at a Tuesday meeting.

The proposal as it currently stands would be to dedicate about $450 million to rebuild three high schools: Benson, Lincoln and Madison. Initial estimates for those schools came in at a combined $600 million.

Related: Lead In The Water

Another $300 million would fund school health and safety repairs, like addressing lead in drinking water. A recent report from the Senior Director for Facilities David Hobbs identified $400 million in health and safety needs, covering everything from lead paint and asbestos remediation to improperly-sealed walls and shaky theater stages.

The prospect of investing in such repairs took on greater significance a month ago, when Portland parents learned of elevated lead levels in two school buildings and past reports of lead at dozens more.

Even with potential trims to the high school projects, $750 million is more than what board members had set as a bond limit. As recently as late June, school board members discussed delaying one of the high school projects to allow spending on health projects, while keeping the bond to $600 million.

Bond committee member Pam Knowles said after Tuesday's meeting that she believes voters will care more about the effect on their own property taxes than the total amount coming to Portland Public Schools.

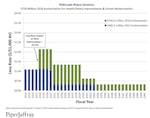

To that end, consultants showed the board’s bond committee how a longer repayment schedule could limit the property tax increase. The firm Piper Jaffray laid out a 30-year bond repayment schedule — a timeline 10 years longer than the current 2012 bond has. By the consultants' math, PPS could limit the tax hike to $1.04 per $1,000 of assessed value — or about $260 annual tax hike for a home assessed at $250,000.

The timeline from consulting firm Piper Jaffray shows the current 2012 PPS bond in blue, and the proposed 2016 bond in green.

Portland Public Schools / PPS

Knowles is privy to private polling the district has conducted, giving her some optimism that a bond could pass this fall. But she said she is also concerned about other money measures slated to appear on the fall ballot.

“I’m hopeful — and I’d like to say confident — but I’m hopeful that voters will see that we need to make sure that our students are in safe buildings and have the best opportunities for an education that we can give them,” Knowles said.

Committee members were optimistic they could trim the costs at Lincoln and Madison. They asked PPS staff to explore the possibility of phasing construction of Benson, projected to be the most expensive of the three high school projects.

Related: Rebuilding 3 Portland High Schools Could Cost $600M

Discussing a potential phasing of Benson High School is just one reminder that the district has a bigger plan in mind. Officials have discussed not just a 2016 bond, but also a potential 2020 bond. It's all part of a 30-year effort, begun in earnest in 2012 with the passage of the $482 million bond, to rebuild and modernize about 80 aging school buildings.

That 30-year plan means property taxes to pay for school construction would rise for Portland Public Schools homeowners, and stay higher, for many years to come.

The bond finance schedule laid out by Piper Jaffray charts an increase in property taxes in 2018, when a 2016 bond would phase in, if voters approved it. The consultants' schedule then shows a decline in taxes in 2022, when taxes associated with paying off the voter-approved 2012 bond would drop. But property owners wouldn't see a drop, according to the plan district officials are considering. The decline of the 2012 bond would be replaced by taxes from a bond voters would see in 2020.

Pam Knowles said the long-term plan is to establish the tax rate at a little above $2 per $1,000 of assessed value (it would be around $2.08 if the proposed 2016 bond were approved by voters), and keep it there.

"The idea is that we want to keep it at that $2 price point from here on out, and keep it more of a renewal than a new bond," Knowles said.

The PPS Bond Committee has another meeting later this month before the full school board is expected to take up possibly referring a bond measure to the ballot this fall.