Oregonians face a major reckoning this fall about the services and programs they’d like to have — and the taxes they’re willing to pay to have them.

Measure 97, on the Nov. 8 ballot, would raise some $3 billion a year in new revenue by raising taxes on large corporations’ gross receipts. That’s enough money to swell the state’s budget by roughly a third.

But the measure has also sparked one of the most expensive election fights Oregon has ever seen.

Advocates say the measure would boost school funding and plug a $1.35 billion budget shortfall driven by pension and health care costs. Without new money, they say, lawmakers would have to cut their way out of debt, with no cushion for the next recession.

Opponents warn of ruin for homegrown businesses, particularly those with low margins, and higher prices for consumers who are likely to bear some of the measure’s cost. Others, wary of government overreach, strongly believe the state must learn to spend within its means.

Hard feelings, win or lose, could roil state politics for years. And Oregonians have only themselves to blame.

More than any other state, Oregon relies on income taxes to pay for programs from foster care to prisons to universal kindergarten — a volatile cash stream that swings wildly along with the finances of the state’s wealthiest residents.

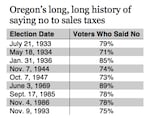

Nine times in nearly 90 years, voters have said no to a sales tax that might ease those ups and downs. Oregon is one of only five states without a general sales tax.

Meanwhile, voters have repeatedly cut back on their property taxes, a traditional source of school funding. And lawmakers have balked at measures that would put limits on state spending. Politicians have tried — and failed — to untangle that knot for decades.

“We basically gave ourselves a structural deficit,” said Rep. Peter Buckley, D-Ashland, a longtime co-chair of the Legislature’s budget-writing committee and a supporter of Measure 97. “We saw expanded needs and expanded expenditures in other areas. And it has yet to get resolved.”

But is Measure 97 the best solution? Some opponents argue it’s not even the right question.

Read more: How Oregon's history of rejecting tax reform opened the door for Measure 97 | Why Oregon has the lowest business tax burden in the U.S.

“We do not need to grow government in Oregon by 30 percent,” said Rep. Mike Nearman, R-Polk County. “We need to find ways to solve our problems by running leaner.”

What Is Measure 97?

Measure 97 would charge certain C corporations a 2.5 percent tax on their gross annual sales of goods and services in Oregon above $25 million.

Right now, businesses in Oregon have the lowest state and local tax burden in the nation, largely because the state lacks a sales tax. Advocates for Measure 97 say the gross receipts tax would ensure companies pay a greater share of Oregon's taxes.

Lawmakers could spend that new money — $6 billion over a two-year budget cycle — as they please. Although they would face political pressure to spend it on the services spelled out in the measure — education, health care and senior services — there’s no guarantee.

Courtesy of The Oregonian/OregonLive

In good economic times, governors and lawmakers have typically used booming income tax revenues to make up for previous budget cuts and expand programs. But when recessions strike, income taxes tend to fall harder and faster than almost any other source of cash. That’s left Oregon especially vulnerable to economic swings.

In 2009 and 2010, in the wake of the Great Recession, lawmakers closed a $4 billion deficit — only two years after pouring in $2.6 billion in new investments. Oregon’s current two-year operating budget is now more than $18 billion.

Paul Warner, an economist and the state’s nonpartisan legislative revenue officer, points to Washington state, which doesn’t have an income tax.

“They’re affected by recessions, but their revenue may decline 1 or 2 percent,” said Warner, appointed by Republican lawmakers in 1999. “Ours will go down 8 to 10 percent the last two recessions. That’s a big difference in stability.”

Some lawmakers have tried their hand at another solution: Limiting costs to bank money. Sen. Doug Whitsett, R-Klamath Falls, called for a spending cap in 2013 after a forecast showed state income growing by 10 percent.

"Most businesses would be pleased with such revenue growth these days," Whitsett, who opposes Measure 97, wrote in The Oregonian/OregonLive. "That kind of revenue increase is not nearly enough, however, to satisfy the Oregon government's spending appetite."

But talk of limits has failed to gain traction in a Legislature that’s mostly been controlled by Democrats since 2007. And interest in tackling one of the state’s heftiest expenses — pension benefits for state workers — sputtered after the Oregon Supreme Court tossed out savings worth $4 billion last year.

Also adding to the churn, some say, is Oregon’s one-of-a-kind “kicker” income tax rebate.

Related: Measure 97 Opposition Reports Raising $17.5M In Contributions

Every time actual collections of personal income taxes at the end of a budget cycle exceed projected collections by more than 2 percent, the state must return the entire surplus to taxpayers. The state gave back $1 billion to taxpayers in 2007.

Voters agreed to claw back a separate kicker on corporate taxes in 2012. That money now goes directly to education.

“Every time we have a good economic upturn in the state, the kicker kicks and the dollars that would have gone into the budget for future use, or reserves, go back to taxpayers,” Buckley said of the income tax kicker, which voters added to Oregon’s constitution in 2000.

Sen. Richard Devlin, D-Tualatin, the Legislature’s other budget writer, said the math behind shoring up Oregon’s budget ought to be simple.

“It’s really not that hard,” said Devlin, who is not taking an official position on the measure and declined to say how he’ll vote. “There are really only three principal resources available: income taxes, property taxes and consumption taxes.”

Sales and gross receipts taxes — the type of tax in Measure 97 — both fall under that last category. And though that might seem simple, the political calculus around that kind of tax has been anything but.

Oregon Says No To Sales Tax ... A Lot

Most states adopted a sales tax in the 1930s. Not Oregon. Voters rejected all three sales tax measures on the ballot that decade. Supporters of the tax tried six more times, most recently in 1993, but voters always said “no.”

“That left Oregon’s revenue system dependent upon comparatively high income and property taxes,” according to a 2009 report by a state revenue task force, one of countless groups assembled over the years to brainstorm solutions.

Jim Moore, director of the Tom McCall Center for Policy Innovation at Pacific University, said opposition to a sales tax has become as ingrained in Oregon culture as full-service gas pumping.

“The counterargument to it starting in 1933 has always been it means that the little guy is going to have to pay taxes, and that’s not fair, it ought to be the big corporations,” Moore said. “That was the argument in the 1930s, and the 1940s, and the 1960s, and every darn one of them.”

For decades, property taxes helped make up some of the difference. But by the 1970s and 1980s, skyrocketing tax bills had left angry homeowners on the verge of rebellion. Around that time, Oregonians had the fourth highest property tax burden in the nation.

Lawmakers realized they needed to take action to avert a property tax revolt similar to one under way in California. In 1978, Californians sharply limited tax rates for homes and businesses and capped increases at 2 percent.

“I knew the public was getting angrier and angrier,” said Senate President Peter Courtney, D-Salem, who was first elected to the Oregon House in 1980.

[series: election-2016,left,56f47da999429c0031c62036]

Courtney joined with Tony Van Vliet, a Republican state representative from Corvallis, to pitch a plan to cut property taxes while adding a 4 percent sales tax. The proceeds would have paid $800 million a year for schools.

Measures based on the idea eventually hit the ballot in 1985 and 1986, but failed both times with just 22 percent support.

“If we’d have done that, I can tell you we would not be here today,” Courtney said, referring to the battle over Measure 97. Courtney said he has not taken a public position on the measure.

Instead, property tax activists went on to pass ballot measures not only cutting property assessment values but also restricting the growth of taxes.

Measure 5, which voters approved in 1990, slashed property tax revenue for cities, counties and schools. Before Measure 5, 30 percent of funding for schools came from state taxes. Now it’s swelled closer to 70 percent, Devlin said.

And as the state stepped in to replace lost school funding, that meant less money for other government programs.

“We gave the school system to the state,” Buckley said, “without the revenue to pay for it.”

Gov. Barbara Roberts, a Democrat, presented one of the state’s most recent sales tax proposals in 1992, when she called a special legislative session to consider a revenue reform package that also included a personal income tax cut and increased property taxes on some commercial real estate.

Related: Kate Brown Calls M97 Only 'Viable Option' For Oregon

It would have raised roughly $950 million every two years, Roberts said. She’d lined up Republican support, but fell short of the number of Democrats necessary to refer the plan to voters.

“I always tell people if they want to reform the tax system in Oregon, all they have to do is go over to the state archives and take my plan and use it,” said Roberts, who has endorsed Measure 97. “It’s sitting there, not even wrinkled.”

Other property tax measures in the 1990s further cut taxes and capped annual growth in assessed values at 3 percent. Reform advocates say that means local property tax revenues often fail to keep up with the cost of services.

Frank Morse, a Republican senator from Albany until 2012, also pushed unsuccessfully for a global overhaul of Oregon’s taxes — including a sales tax. But the futility of pushing reforms, first on taxes and then on spending, eventually drove to him resign before the end of his last term.

“I invested heavily in trying to help move our state in the right direction with fiscal policy… Then I said, ‘I’m done,’” said Morse, who described Measure 97 as “a mess.”

'They Want This Fight'

Lawmakers sowed more seeds for Oregon’s current tax showdown in 2009. Desperate to avoid cutting their way out of debt, a supermajority of Democrats in the House and Senate sent ballot measures to Gov. Ted Kulongoski raising taxes on corporations and the wealthy.

Related: Measure 97, PERS Divide Candidates For Oregon Treasurer, Secretary Of State

Together, the measures were supposed to raise an estimated $764.6 million over two years. Voters approved Measures 66 and 67 in 2010 after what became a bitter and expensive fight.

The tax hikes went on to raise $607 million in that budget. Democrats, however, fell into a tie in the House that fall.

Memories of those measures hung over the Capitol in recent years. In 2014, Gov. John Kitzhaber talked about tax reform and negotiated with business and labor groups to keep corporate tax measures similar to Measure 97 off the ballot.

This year, lawmakers who tried to bring union and business leaders together for a compromise to forestall Measure 97 discovered neither side would even sit down unless the other side made major concessions. Oregon’s public employee unions are among Measure 97’s fiercest supporters.

“I have concluded they want this fight,” Courtney said, adding that both sides are “fed up” with each other and believe they can win.

Sen. Mark Hass, D-Beaverton, pitched an alternative proposal in February that would have raised $500 million annually, through a much smaller gross receipts tax levied on a broader group of corporations.

For months, Hass met with Gov. Kate Brown, other lawmakers and interests on both sides of the measure trying to build support. Hass said a compromise probably would have cleared the Senate, the smaller and more conservative of the state’s legislative chambers. Democrats hold majorities in both.

But Hass soon realized it had no chance in the House, where Speaker Tina Kotek, D-Portland, firmly supports Measure 97. Brown has endorsed the measure, too.

“I felt like people were counting on me to find some middle ground there and I felt like I failed,” said Hass, who said in an interview he doesn’t support the measure. “But I also understand that there are certain things that are out of your control. And this was one of them.”